AJC’s recent article entitled “Why Vanderbilts should inspire you to create an estate plan” explains that when Cornelius Vanderbilt died, his son, William, inherited most of the fortune and nearly doubled it within a decade. However, after that came a drop in the cash, and after just a few decades, the fortune had been spent. Therefore, none of Vanderbilt’s descendants stayed among the wealthiest people in the country.

When 120 Vanderbilt family members recently gathered for a reunion at Vanderbilt University, not one was a millionaire. In a century, the largest estate America has ever known had dwindled to next to nothing.

Let’s look at why this happens and how you can prevent this from happening to your estate.

America is currently in the midst of the greatest transfer of wealth ever. An estimated $59 trillion will be transferred to heirs, charities and taxes between 2007 and 2061. However, roughly 70% of wealth transfers aren’t successful. This means that sometimes heirs get practically nothing. There are three reasons for this failure:

- No trust and communication among heirs because they’re all concerned about their share.

- Heirs are unprepared to inherit an estate, which may include managing investments or a business. In many cases, other family members don’t know how it works.

- Heirs have no clue where the money should go and what purpose it should serve because no one is thinking long term about what is best for the family assets.

It’s common for business owners to believe that an estate plan is enough to keep everything in order, but they don’t consider their business. This is the reason why succession planning is vital. This planning determines what happens to the business itself and lays out the strategy, so it continues to operate smoothly after it’s passed to the heirs.

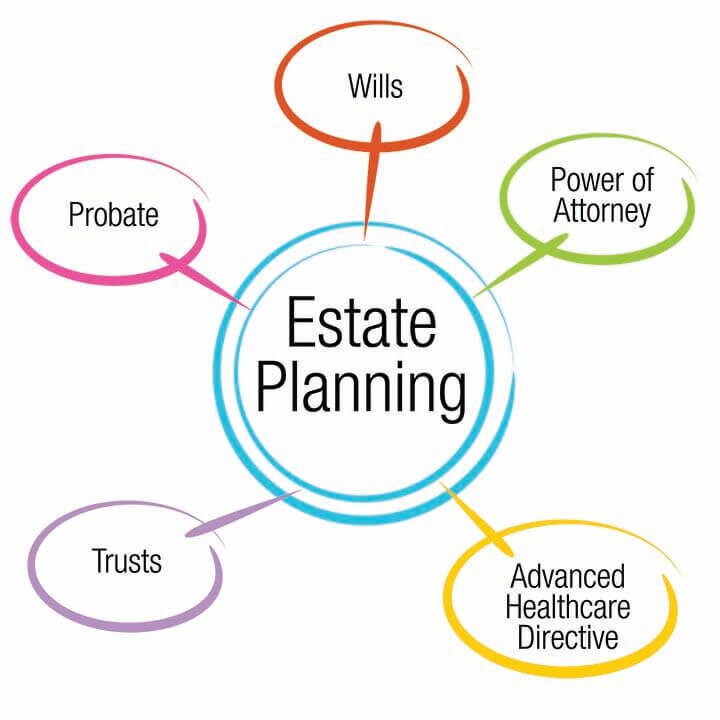

Let’s look at some tips for dealing with estate planning that should make for a smooth transition:

Create a plan. If you die without a will, state probate law will determine who gets your assets. This may not be what you want. Talk to an experienced estate planning attorney to be certain that everything is drawn up correctly.

Discuss the issues with your heirs. Talk to your family about the financial details. Make sure that your heirs know the details of your estate, so they can start to manage and oversee it once you die.

Get heirs involved in the process. Likewise, heirs can help plan based on their knowledge, future availability and expectations. By planning now, no one will be caught unaware about what to do with the estate.

Ready your heirs. Educate your heirs on how to manage and oversee your assets, especially if you have a succession plan for a business. Discuss the company’s mission and vision, and what you want the company to achieve.

Organize your financial documents. Get all financial documents in a single location and label everything clearly to help out your heirs. Keep this in a safe location, and let your heirs know where it’s located. Your attorney should also have a copy of your will, estate plan and succession plan (if applicable).

Get help from experts. Help forge a relationship between your heirs and your financial team, which may include a financial adviser, an estate planning attorney and an accountant. This will allow your heirs to know who to call, if things get complicated. It’ll also help to prepare them for what they’re supposed to be doing, once they get their inheritance.

Communication is the key. Talking with your experts and your heirs will make certain that everyone understands each other’s roles, regardless of whether it’s a small business or a multimillion-dollar empire.

Reference: AJC (Sep. 25, 2020) “Why Vanderbilts should inspire you to create an estate plan”

Suggested Key Terms: Estate Planning Lawyer, Wills, Intestacy, Probate Court, Inheritance, Asset Protection, Probate Attorney, Charitable Donation, Business Succession Planning, Retirement Planning