A power of attorney is a legal document that permits an agent or attorney-in-fact to make financial and legal decisions on your behalf, if you are unable to do so.

WTOP’s recent article “How to Set Up a Power of Attorney” says that the rules for designating power of attorney vary from state to state. Because of this, you should speak to an experienced estate planning attorney about your state’s laws.

Power of attorney is revocable. Therefore, if you’re mentally competent and believe you can no longer count on the person you designated as your agent, you can update your documents and select another person.

The individual you choose as your attorney-in-fact will depend to a large extent on the type of power you’re granting — whether it’s general or limited — and your relationship. For general power of attorney, people often go with their spouses or sometimes their children. However, you can choose anyone, as long as it’s someone you trust.

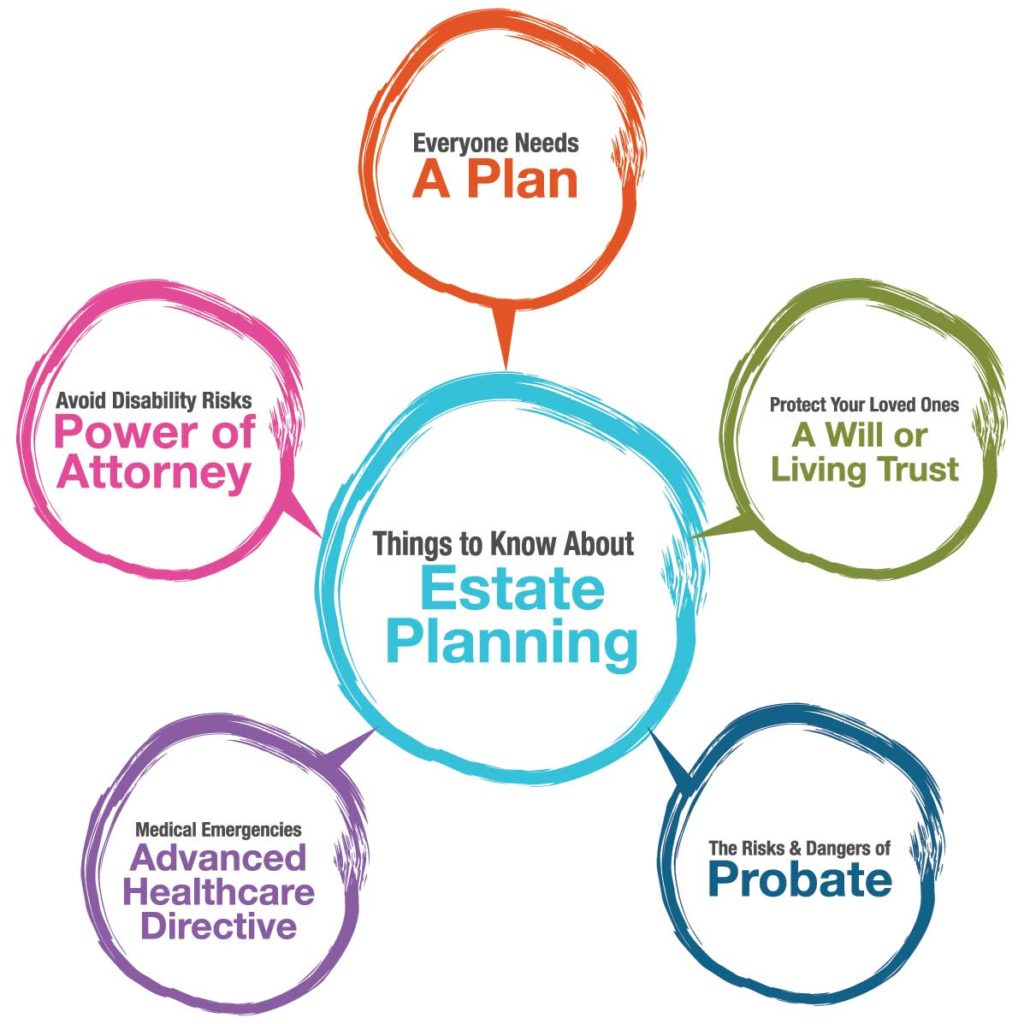

In many cases, designating general power of attorney is a component of a larger estate plan, so when you talk to your estate planning lawyer about your estate plan, you can add this to the conversation.

You may want to have your attorney draft a limited or special power of attorney. This lets your agent complete restricted transactions, like selling a piece of property. It’s limited in scope. In contrast, a general power of attorney lets your agent do about anything you could do. A general power of attorney is usually part of an estate plan, in the event you’re unable to handle your own financial matters as you age or become incapacitated.

A springing power of attorney goes into effect in a predetermined situation, and it will specify the circumstances under which the power takes effect. An immediately effective or non-springing power of attorney is in place once the paperwork is signed.

Powers of attorney typically end when the principal is unable to make decisions on his or her own. However, for some, becoming incapacitated is just the type of circumstances when they want someone they trust to have power of attorney.

A durable power of attorney continues after the individual is incapacitated. Therefore, if you’re unable to make financial or medical decisions on your own after an accident or illness, the POA will remain in effect.

You are generally also able to name a medical power of attorney. That’s a person who knows your wishes and can make health care decisions for you as a proxy. It’s also known as a health care proxy. If you can’t make decisions on your own, the health care proxy kicks in. Your health care proxy should know your wishes, as far as how you’d like doctors to treat you, if you can’t make decisions on your own. This may also accompany a living will, which expresses your wishes on continuing life support, if you’re terminally ill or being kept alive by machines.

Reference: WTOP (May 21, 2020) “How to Set Up a Power of Attorney”

Suggested Key Terms: Elder Law Attorney, Estate Planning, Power of Attorney, Living Will, Health Care Proxy